MYOB Exo Employer Services 2020.02 Update

MYOB Exo Employer Services, otherwise known as MYOB Exo Payroll, have just released an update and a new version : MYOB Exo Employer Services 2020.02.

The key points of this update include:

- Enhancement provided to allow users to better control leave accruals when staff on work cover.

- Enhancements around terminations, superannuation and leave loading.

- Updates for Termination payments

- Update for Victorian Payroll Tax for employers in bushfire-affected local government areas.

The MYOB Exo Payroll 2020.02 release also contains compliance updates for the 2020/2021 payroll year.

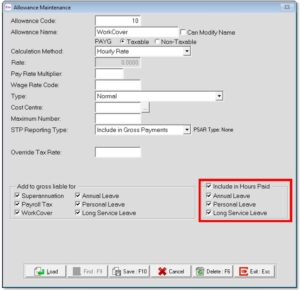

Hours Paid Options for Allowances

This release adds options to better support workers compensation (WorkCover). Different states have different rules for whether or not leave accumulates during workers compensation. For more information visit the Annual Leave and Sick Leave during Workers Compensation on the Australian Fair Work website for details.

Leave Loading and Superannuation

In previous releases, leave loading on unused Annual Leave in a termination pay was incorrectly included in superannuation calculations. As of this release, leave loading is no longer included in superannuation in this situation, and a new option has been added to the Pay Item Liabilities section of the Setup Payroll window

Termination Updates

This release includes updates to address the changes related to the tax treatment of genuine redundancy and early retirement scheme payments. New warning messages appear on the Termination Wizard if an invalid combination is selected.

Victoria Payroll Tax

While the standard payroll tax rate in Victoria is 4.85%, different rates apply for employers who pay at least 85% of their Victorian taxable wages to regional employees.

Workplace Giving Deductions

To work correctly with Single Touch Payroll, any deductions set up for Workplace Giving should be pre-tax deductions (i.e. the Post-Tax checkbox should not be ticked). This release adds validation to the Deductions window to warn users if a deduction has the STP Reporting Type Post-Tax checkbox ticked.

We recommend that you review any existing Workplace Giving deductions you have set up and make sure that they are configured as pre-tax.

And, as always, this new MYOB Exo Payroll Update 2020.02 release includes several bug fixes and resolves several known issues.

Click here to download your copy of the MYOB Exo Employer Services 2020.02 Release Notes.

As your Business Partner, Acacia Consulting Services is help you prepare and be available to you for any help or questions that you might have as a result of this upgrade.

Or, if you are looking for an experienced MYOB Business Partner to help you implement MYOB Advanced into your business and would like to discuss your needs, then please let us know.

If you have any questions, please either:

or

phone us on +61 3 8560 5220