MYOB Exo End of Financial Year Rollover Procedures

THAT time of year is fast approaching – so thoughts turn to preparing for the MYOB Exo End of Financial Year Rollover Procedures within your business – and how to get the details you need into and out of your MYOB Exo.

This blog post article will provide you with an overview to help get you started.

Please don’t forget that we at Acacia Consulting Services are here to help if you need it !

Getting Started

The MYOB Exo End of Financial Year Rollover Procedures are located on the same MYOB Exo screen as the End of Period process.

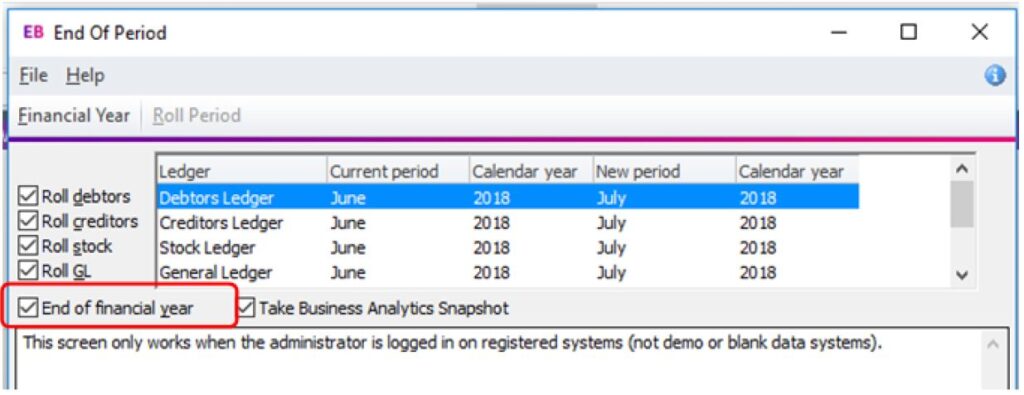

To rollover MYOB Exo at the end of the financial year you follow the same steps and processes you do for your end of period rollover with the addition of ticking the ‘End of financial year’ checkbox.

It is recommended that all modules and the End of Year are run simultaneously.

The End of Year procedure CAN NOT be run without rolling end of period.

The instructions below are generic and may not reflect the specific needs of your business or have exact screen shot matches of your database.

If you require assistance with your end of year reconciliations or rollover please contact Acacia Consulting Services.

Complete your end of period process/checklist as normal.

This would normally include:

• Reconcile the Aged Receivables and Aged Payables reports to the general ledger

• Reconcile the Stock Valuation report to the general ledger (or post the closing stock value if running the Periodic Stock Method).

• Reconcile the bank account/s.

Additional items might include:

• Reconcile your payroll reports to the general ledger

• Reconcile your Fixed Assets Register to the general ledger

• Reconcile your clearing accounts including superannuation payable, PAYG/GST payable, Purchases/On Costs Clearing

Prepare for your End of Year Rollover

Finalise your Stocktake.

Where possible it is best to finalise and upload your stocktake before transacting in the new financial year. This allows you to print a Stock Valuation report as at the end of financial year and reconcile it to the general ledger.

Update foreign exchange rates.

If unrealized foreign currency gains/losses are “taken up”, it is recommended that exchange rates are updated prior to the rollover. This ensures the automatic ‘take up’ of unrealized foreign currency gains/losses uses up to date exchange rates.

Older version of Exo may not prompt you to ‘take up’ foreign currency gains/losses at time of rollover, in which case you will need to manually run the Foreign Exchange Rate Calculator to recognize these amounts.

It is advised your run this tool prior to rolling your end of year.

To update the exchange rates via the picture menus click on “General Ledger” – “Update Exchange Rates”

Alternatively, you could update the rates via your drop-down menus “Setup” – “Business Admin Settings” then by select “Currencies” on the left-hand side.

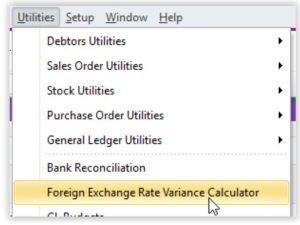

To manually take up unrealized foreign currency gains/losses click on the Exchange Rate Variance Calculator button located on the End of Period picture menu.

Or the Utilities drop-down menu.

Post All Sub-Ledgers to the General Ledger.

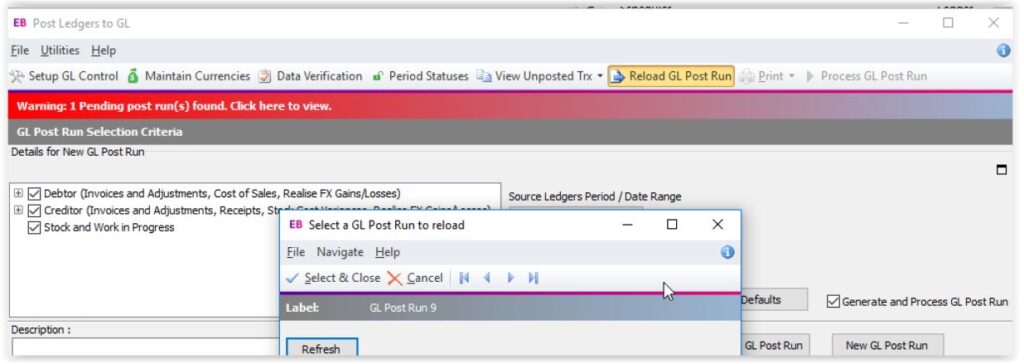

Remember to check for any ‘pending’ batches, which should be evidenced by the red banner at the top of the screen, but it is advised to click on the Reload GL Post Run button to see if any batches appear in the pop-up screen.

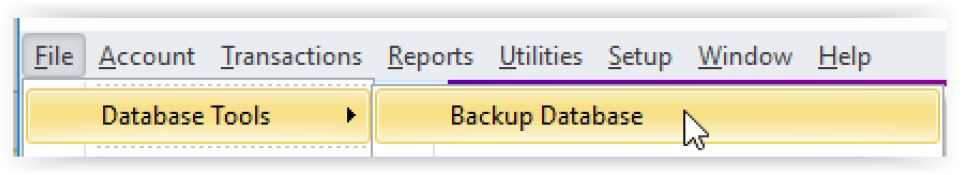

Backup the Database

Prior to performing your MYOB Exo End of Financial Year Rollover Procedures, it is advised that a database backup is completed.

You can do this by clicking on “Backup Database” from your drop-down menu “File” – “Database Tools”.

Follow the prompts that appear on screen.

Fixed Assets

If you have the Fixed Assets Module you will need to roll the end of year in the Fixed Assets Module separately. It is recommended this is done prior to rolling your end of financial year in Exo Finance.

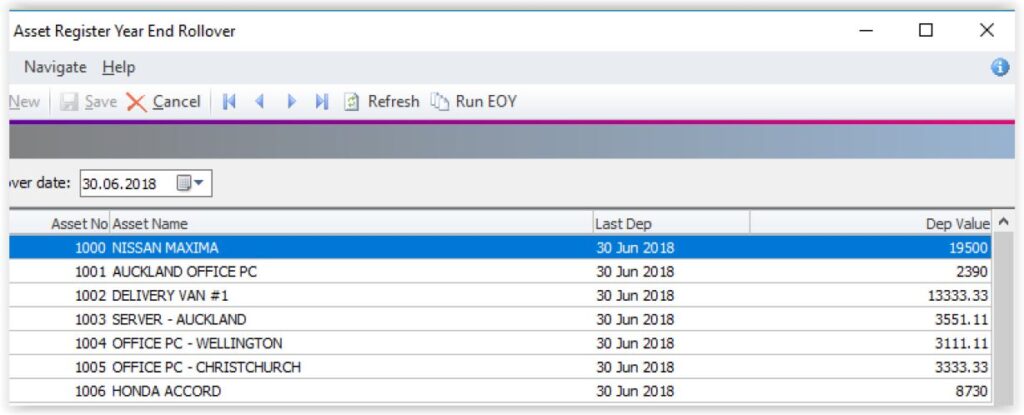

Open the Asset Register module.

Add any new assets as needed.

Dispose/Write Off any assets as needed.

Depreciate all assets up to the last date of the financial year (eg 30/06/2018).

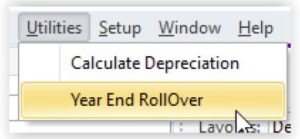

Click on the ‘Year End Rollover’ option on your drop-down menu.

Set the rollover date to be the same as the depreciation date entered above. The assets in the rollover screen should all be black in colour.

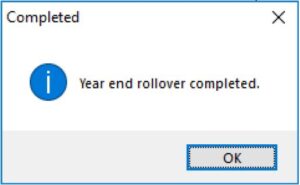

Click the Run EOY button at the top of the screen. You should receive the message:

Rollover the Financial Year

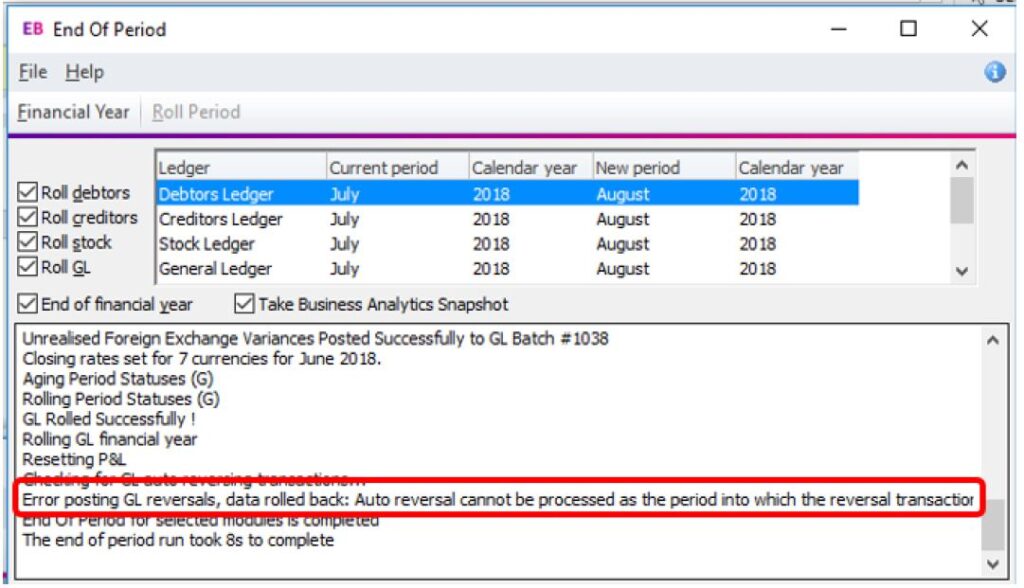

Go to the End of Period screen to rollover the end of period. Tick to roll all periods (Debtors, Creditors, Stock and GL) AND tick End of financial year as well. Tick the ‘Take Business Analytics Snapshot’ check box if you normally do at end of period (this box is normally ticked by default).

Click the Roll Period button at the top of the screen.

Depending on your version you may be prompted to create entries for Unrealised Foreign Currency Gains/Losses. Click Yes or No to his message depending on your business’ requirements (we suggest you communicate with your accountant if unsure about this).

If you are not prompted for this option but you do wish to take up a provision for unrealised foreign currency gains/losses you will need to manually run the foreign currency exchange rate calculator.

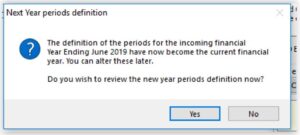

You may be prompted to ‘define next year periods’. Click Yes to this message.

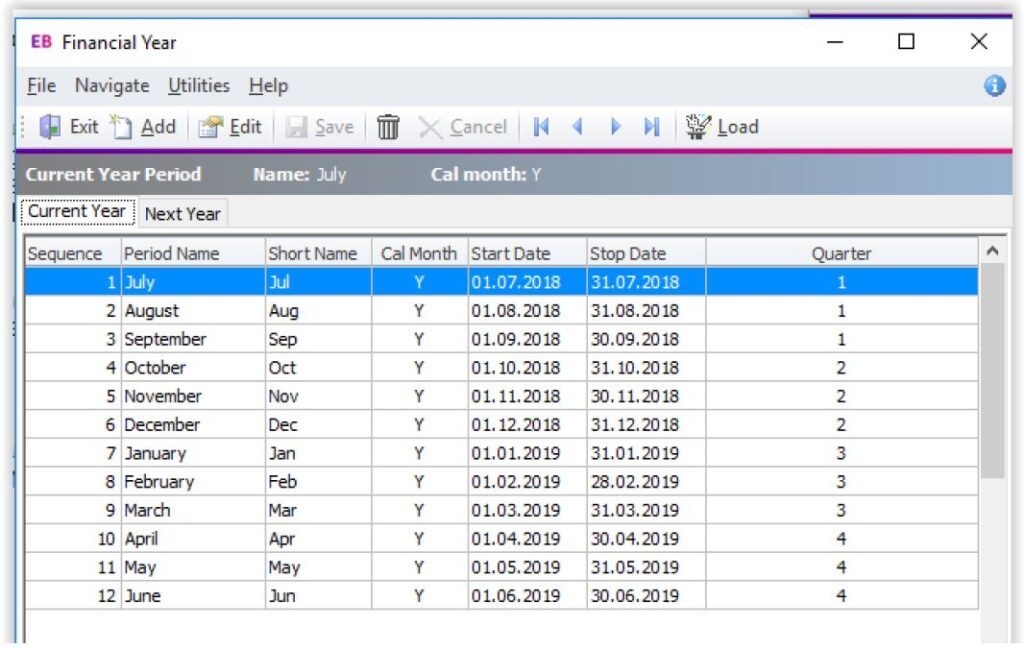

Review the following screen and ensure the dates are correct:

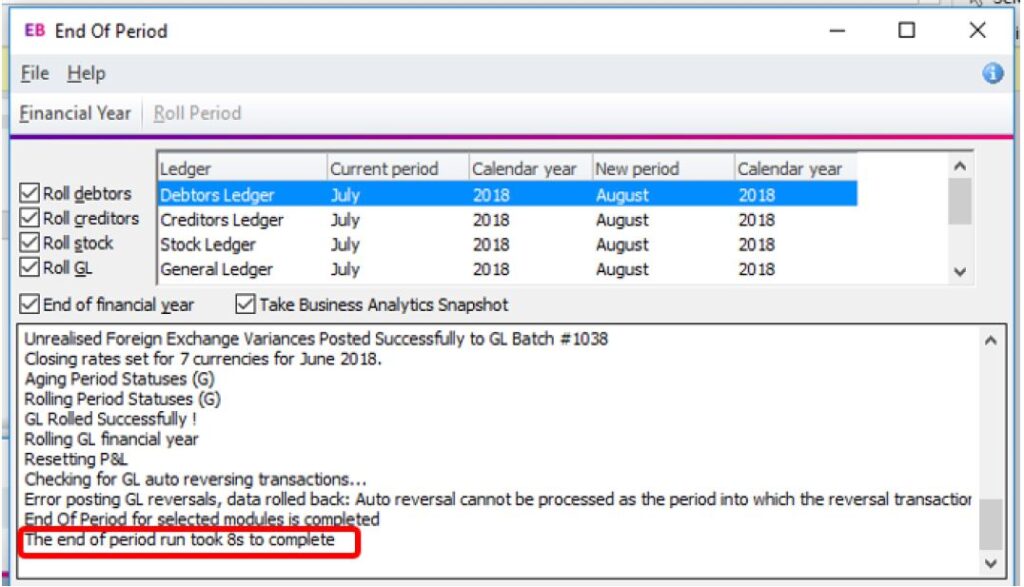

Once complete you will see a screen where the last line specifies that the end of period is complete.

If you see a line stating that Auto reversal journals could not be processed, please contact us so we can identify what journals have not processed and why (this is usually related to the automatic reversal of previous period unrealised foreign currency entries).

Once the End of Year rollover is complete users can still post transactions into prior financial years if required and the system will automatically make the necessary adjustments to retained earnings.

There are a lot of i’s to dot and t’s to cross when it comes to the end of financial year reporting period for your business.

The MYOB Exo End of Year Rollover Procedures mentioned above will help you get the real numbers picture from your business – which is now more important than ever, given the recent business upheavals of recent months.

Further reading : below is one of our previous blog posts that may also be of use as you get ready to run your MYOB Exo End Of Financial Year Roll Over Procedures.

If you need a hand with your business, particularly with extracting the data you need to see, then please :

give us a call on ph +61 3 8560 5220

or Contact Us.

Acacia Consulting Services is here to help you take your business to the next level!