From 1 November 2021 there are changes to comply with pertaining to Superannuation Choice of Fund rules, namely, stapled superannuation funds. Each employee now has an existing super account which is linked, or ‘stapled’, that follows them as they change jobs. This change will help stop new superannuation accounts from being opened every time an employee starts a new job. As an employer, after 1st November 2021 you may need to request Stapled Superannuation fund details when:

- your new employee starts on or after 1 November 2021

- you need to make super guarantee payments for that employee, and

- your employee is eligible to choose a super fund but doesn’t.

For every new employee there are three steps to take:

- Offer the Superannuation Standard Choice form – ideally you will receive completed form detailing the chosen Superannuation Fund

- If the employee doesn’t provide a completed Superannuation Standard choice form, as the employer, you must request the Stapled Superannuation Fund details from the ATO

- Enter the Superannuation Fund into your payroll and pay the superannuation

Step 1: Offer your eligible employees a choice of superannuation fund

There is no change to this step of your super obligations. If your employee has chosen a super fund, you can pay super contributions to the chosen fund.

- Superannuation Standard choice form (new form 1/11/2021)

- Superannuation standard choice form Instructions

Step 2: Request stapled superannuation fund details

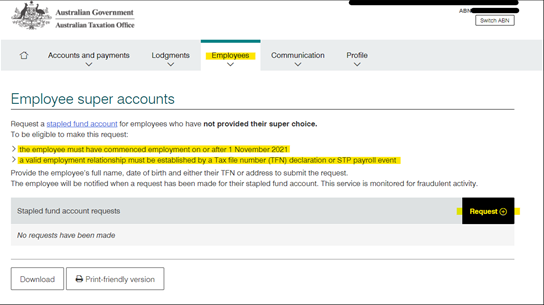

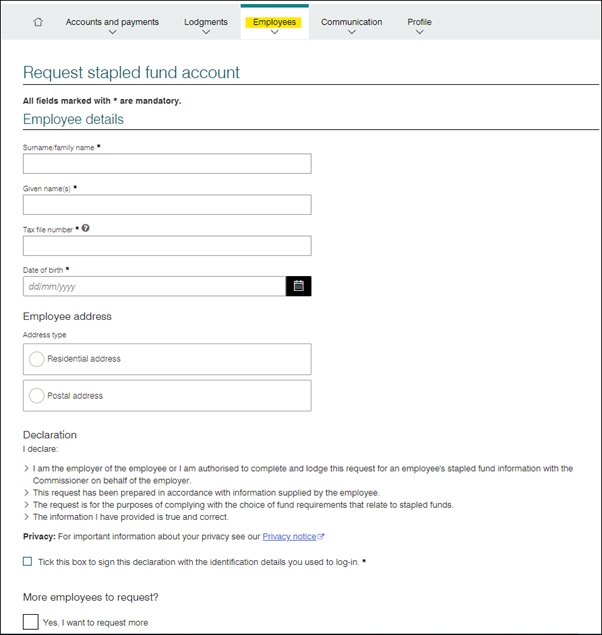

If your employee doesn’t choose a super fund (using the Superannuation Standard Choice Form), you will need to log into the ATO online services to request their stapled super fund details. You’ll be able to request your employee’s stapled super fund after you have submitted a ‘Tax file number declaration’ or Single Touch Payroll pay event linking the employer to the employee. A step-by-step guide for the process can be found here, some key points are summarised below:

- Login to the ATO Online Services Portal

- Use your MyGovID application to enter the two-factor authentication code. Select the correct company for the employees in question.

- From the menu, select Employees

- The Request stapled fund account screen will open, enter the employee’s details, and submit

The ATO have also advised that a bulk request form will be available if you need to request stapled super fund details for over 100 new employees at once.

Step 3: Pay super into the stapled superannuation fund

If the Employee (via Super Choice Form) or ATO provide a stapled super fund result for your employee, you must pay your employee’s super guarantee contributions to the stapled super fund details provided to you. Use your default superannuation fund, or another fund that meets the choice of fund rules if:

- your employee doesn’t choose a super fund, and

- The ATO have advised you that they don’t have a stapled super fund.

Other considerations

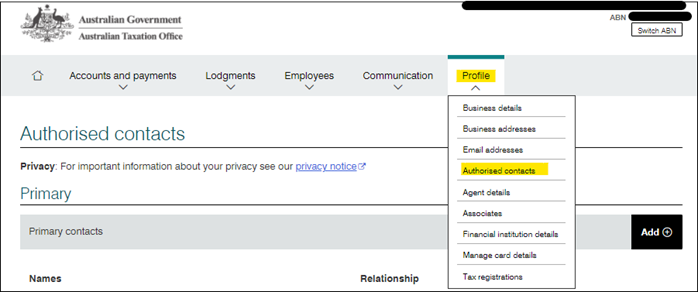

To be able to request a stapled super fund, check and update the access levels of your authorised representatives in ATO online services. Use the Profile tab to manage your Authorised Contacts:

Disclaimer:

Acacia is not an Authorised BAS agent. Should you have any further queries, please contact the ATO or your accountant, as these are ATO requirements changes and there is no change to any payroll software.